The boardroom has always been where the most consequential business decisions are made. But today, there’s a new seat at the table, and it’s not human.

Artificial Intelligence isn’t just changing how companies operate. It’s revolutionizing how the most successful boards govern.

While some directors still struggle with basic AI concepts, elite board members are already leveraging advanced prompt engineering techniques to gain unprecedented strategic insights, identify risks before they materialize, and ask the questions that management never saw coming.

The Wake-Up Call Every Director Needs

McKinsey’s 2025 AI Transformation Report reveals that companies implementing advanced prompt engineering practices saw: 30% reduction in time-to-market for tech products, 25% increase in customer satisfaction scores in AI-supported service environments, 40% boost in creative content volume in publishing and marketing sectors.

So why are most board members still asking basic AI questions? If your competitors are using sophisticated AI frameworks to predict market disruptions, identify performance gaps, stress-test responses, and uncover competitive blind spots, shouldn’t boards be doing the same?

The directors who master these capabilities won’t just survive the AI transformation, they’ll lead it.

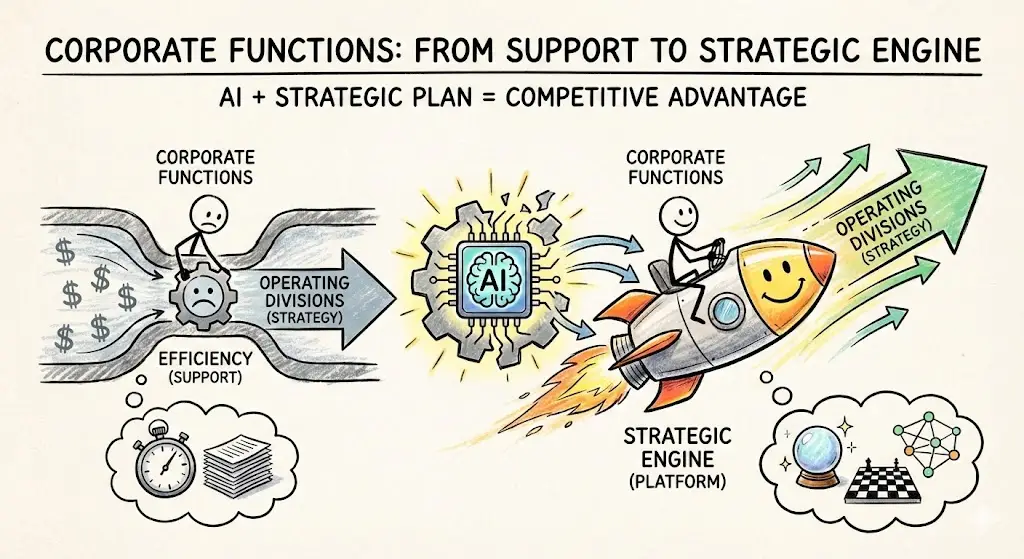

From Reactive Oversight to Predictive Governance

Traditional board oversight looks backward. You review last quarter’s numbers, analyze completed deals, and hope management is telling you everything you need to know.

AI-powered governance looks forward.

Imagine walking into your next board meeting with real-time competitive intelligence, predictive risk analysis, performance benchmarking that shows exactly where your CEO ranks against industry peers, and scenario modeling that stress-tests your crisis response plans.

This isn’t science fiction. It’s what forward-thinking directors are already doing with advanced prompt engineering frameworks.

The Research-Backed Frameworks Elite Boards Use

1. Mega-Prompt Integration: Context is King

One of the most significant trends in prompt engineering is the use of mega-prompts. Unlike traditional short prompts, mega-prompts are longer and provide more context, which can lead to more nuanced and detailed AI responses .

Example Board Application – Strategic Market Analysis:

You are a seasoned strategy consultant with 20+ years board advisory experience. I need you to systematically analyze our competitive position using the ReAct framework.

CONTEXT:

[Company Name] operates in [specific industry sector] with $[revenue] annual revenue, [employee count] employees, competing primarily with [top 3 competitors].

TASK STRUCTURE:

Thought: First, identify the key strategic questions I should be asking

Action: Research each competitor's strategic moves over past 18 months Observation: Document what you discover about their initiatives Thought: Analyze patterns and identify gaps in our current strategy

Action: Apply Porter's Five Forces framework to structure findings Observation: Synthesize into board-ready insights

DELIVERABLE REQUIREMENTS:

- Structure response using Porter's Five Forces

- Identify 3 critical blind spots we may have

- Provide 5 specific strategic questions for management

- Include competitive threat probability matrix

- Suggest 3 board oversight mechanisms for monitoring

2. ReAct Framework: Systematic Intelligence

ReAct is inspired by the synergies between “acting” and “reasoning” which allow humans to learn new tasks and make decisions or reasoning . ReAct is a combination of reasoning and acting. The paper that introduced ReAct showed it to be better than chain-of-thought prompting .

Example Board Application – Risk Assessment:

ROLE:

Crisis management expert designing board-level crisis response protocols.

SCENARIO:

[Specific crisis type - cyber attack, product recall, executive misconduct] REACT

FRAMEWORK ANALYSIS:

THOUGHT 1: What are the immediate risks and required decisions in the first 4 hours?

ACTION 1: Map critical decision points and required board involvement

OBSERVATION 1: [Document key insights about timing and authority]

THOUGHT 2: Who are all affected stakeholders and what do they need to know?

ACTION 2: Design communication matrix with timing and messaging

OBSERVATION 2: [Note communication dependencies and potential conflicts]

THOUGHT 3: What legal and regulatory obligations must be met?

ACTION 3: Create compliance checklist with regulatory notification requirements

OBSERVATION 3: [Identify potential legal vulnerabilities and protective measures]

DELIVERABLE REQUIREMENTS:

1. Crisis Decision Authority Matrix

2. Stakeholder Communication Playbook

3. Board Emergency Protocols

4. External Advisor Engagement Framework

5. Post-Crisis Learning Process

3. Self-Consistency Validation: Crowd-Sourced Accuracy

Self-consistency aims “to replace the naive greedy decoding used in chain-of-thought prompting”. The idea is to sample multiple, diverse reasoning paths through few-shot CoT, and use the generations to select the most consistent answer .

Example Board Application – CEO Performance Evaluation:

You are designing a comprehensive CEO evaluation framework. Generate this assessment using multiple reasoning pathways to ensure accuracy.

VALIDATION REQUIREMENT:

After completing your analysis, review your findings and validate the top 5 performance metrics using a second reasoning path to ensure consistency.

FRAMEWORK COMPONENTS:

1. QUANTITATIVE METRICS (70% weighting): - Financial performance indicators - Operational excellence measures - Strategic goal achievement

2. QUALITATIVE ASSESSMENTS (30% weighting): - Leadership effectiveness - Stakeholder relationship quality - Crisis management capability

3. COMPARATIVE BENCHMARKING: - Against industry peer CEOs - Historical performance trends - Board expectations vs. delivery Generate this framework using two different approaches, then synthesize the most robust elements from each.

4. CLEAR Structure: Precision Communication

The CLEAR Framework for Prompt Engineering, designed to optimize interactions with AI language models like ChatGPT. The framework encompasses five core principles—Concise, Logical, Explicit, Adaptive, and Reflective—that facilitate more effective AI-generated content evaluation and creation .

Example Board Application – Financial Analysis:

ROLE: You are a sophisticated financial analyst preparing board-ready insights.

CLEAR STRUCTURED ANALYSIS:

CONCISE OBJECTIVE: Identify 3 areas requiring board probing questions about management's financial strategy and performance.

LOGICAL SEQUENCE:

Step 1: Parse key financial metrics (revenue growth, margins, cash flow, debt ratios, ROIC)

Step 2: Benchmark against [Competitor A], [Competitor B], [Competitor C]

Step 3: Identify performance gaps and outliers

Step 4: Formulate specific board questions

Step 5: Recommend ongoing monitoring mechanisms

EXPLICIT REQUIREMENTS:

- Use 3-year trend analysis minimum

- Include peer-adjusted metrics where material

- Flag any accounting methodology differences

- Provide confidence intervals for projections

ADAPTIVE ELEMENTS:

Tailor analysis depth based on: [current market volatility], [recent M&A activity], [regulatory changes]

REFLECTIVE VALIDATION:

After analysis, ask yourself: "What would the most experienced board member question about these findings?" Then enhance recommendations accordingly.

5. Chain-of-Thought Integration: Transparent Reasoning

Chain-of-thought (CoT) prompting enables complex reasoning capabilities through intermediate reasoning steps. You can combine it with few-shot prompting to get better results on more complex tasks that require reasoning before responding .

Example Board Application – ESG Strategy Development:

Develop a comprehensive ESG strategy using systematic reasoning pathways.

REASONING TREE STRUCTURE:

BRANCH 1 - ENVIRONMENTAL PATHWAY:

Thought: What are our material environmental impacts? → Sub-analysis: Carbon footprint, resource consumption, waste generation → Industry comparison: How do leaders in our space approach these issues? → Stakeholder expectations: What do investors, customers, regulators demand? → Business case: ROI analysis for various environmental initiatives

BRANCH 2 - SOCIAL PATHWAY:

Thought: What social factors most impact our business model? → Sub-analysis: Employee welfare, community impact, supply chain ethics → Risk assessment: Reputational, operational, and regulatory risks → Opportunity identification: Competitive advantages through social leadership → Measurement framework: KPIs and tracking mechanisms

BRANCH 3 - GOVERNANCE PATHWAY:

Thought: How does ESG integrate with existing governance structures? → Board oversight mechanisms: Committee structure and responsibilities → Management accountability: Incentive alignment and reporting → Transparency framework: Disclosure standards and stakeholder communication

SYNTHESIS REQUIREMENTS:

After exploring each branch, synthesize into:

1. Integrated ESG strategy with clear priorities

2. 3-year implementation roadmap

3. Board governance structure

4. Performance measurement dashboard

5. Stakeholder communication plan

Complete Board AI Toolkit: Advanced Prompts

Strategic Oversight Prompts

Market Intelligence Analysis:You are a seasoned strategy consultant.

Analyze [Company Name]'s competitive position in [specific industry].

Compare our strategic initiatives against top 3 competitors over the past 18 months.

Identify emerging threats and opportunities we may be missing.

Structure your analysis using Porter's Five Forces and highlight specific board-level strategic questions we should be asking management.

Enterprise Risk Assessment:

Acting as a chief risk officer, evaluate the top 5 enterprise risks facing [Company/Industry] in the next 24 months.

For each risk, provide:

(1) probability and potential impact,

(2) current mitigation strategies in the market,

(3) specific board oversight mechanisms needed, and

(4) key performance indicators we should monitor quarterly.

Financial Oversight Prompts

Financial Deep Dive:

Review our latest 10-Q/10-K and compare key financial metrics (revenue growth, margins, cash flow, debt ratios) against industry benchmarks and our top 3 public competitors.

Identify 3 specific areas where the board should ask probing questions of management and suggest the exact questions to ask.

Capital Allocation Review:

Analyze our capital allocation strategy over the past 3 years.

Compare our R&D spending, capex, acquisitions, and shareholder returns against industry leaders.

What board-level questions should we ask about management's capital allocation decisions for the upcoming fiscal year?

Management Oversight Prompts

CEO Performance Framework:

Create a comprehensive CEO evaluation framework for a [company size/industry] company.

Include:

(1) quantitative metrics weighted by importance, (2) qualitative leadership competencies, (3) stakeholder feedback mechanisms, (4) peer CEO benchmarking criteria, and (5) specific development areas the board should discuss in executive session.

Succession Planning:

Design a robust succession planning process for our C-suite roles.

Include emergency succession protocols, internal talent development programs, external candidate criteria, and a timeline for board review.

What specific information should the board request from management quarterly regarding succession readiness?

Governance & Compliance Prompts

ESG Strategy Development:

Develop a comprehensive ESG strategy for [Company Name] that aligns with our business model and stakeholder expectations.

Include: (1) material ESG factors for our industry, (2) specific metrics and targets, (3) reporting framework, (4) board oversight structure, and (5) investor communication strategy.

Regulatory Risk Assessment:

Identify the top regulatory and legal risks facing [Company/Industry] over the next 2 years.

For each risk, provide: (1) specific regulatory changes to monitor, (2) compliance requirements, (3) potential financial impact, (4) board reporting mechanisms needed, and (5) questions the board should ask legal counsel.

Crisis Management Prompts

Crisis Preparedness Framework:

Create a crisis management framework for the board's role during [specific crisis type].

Include:

(1) immediate board response protocols,

(2) stakeholder communication responsibilities,

(3) decision-making authorities,

(4) external advisor engagement, and

(5) post-crisis evaluation process.

Scenario Planning:

Develop 3 detailed scenarios (bull case, base case, bear case) for our industry over the next 3 years.

For each scenario, outline:

(1) key assumptions and triggers,

(2) impact on our business model,

(3) strategic responses required,

(4) board decision points, and

(5) early warning indicators to monitor.

The Competitive Advantage Hidden in Plain Sight

While your competitors debate whether to allow AI in the boardroom, you could be using these research-backed frameworks to transform governance from reactive oversight to predictive advantage.

The frameworks exist. The technology is proven. The competitive advantage is waiting.

The directors who master AI-powered governance in 2025 will shape the next decade of business leadership. Those who don’t risk becoming relics of a bygone era.

What’s your first move?

Ready to transform your board effectiveness with AI? The future of governance is being written now—and the most successful directors are holding the pen.

#BoardGovernance #AILeadership #PromptEngineering #DigitalTransformation #ExecutiveLeadership