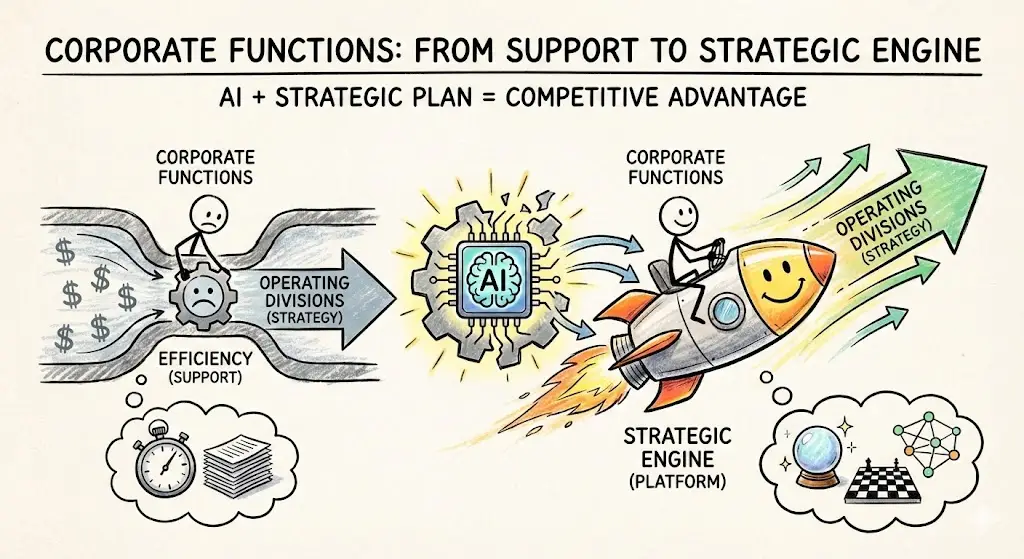

AI turns “support” into a strategic engine, or a strategic liability

For decades, most companies have operated with an unspoken hierarchy. Operating divisions are where strategy lives, where growth is created, and where success is celebrated. Corporate functions are where cost is managed, risk is contained, and work is kept in motion. Everyone says functions are “strategic partners,” yet budgets and status tell a different story.

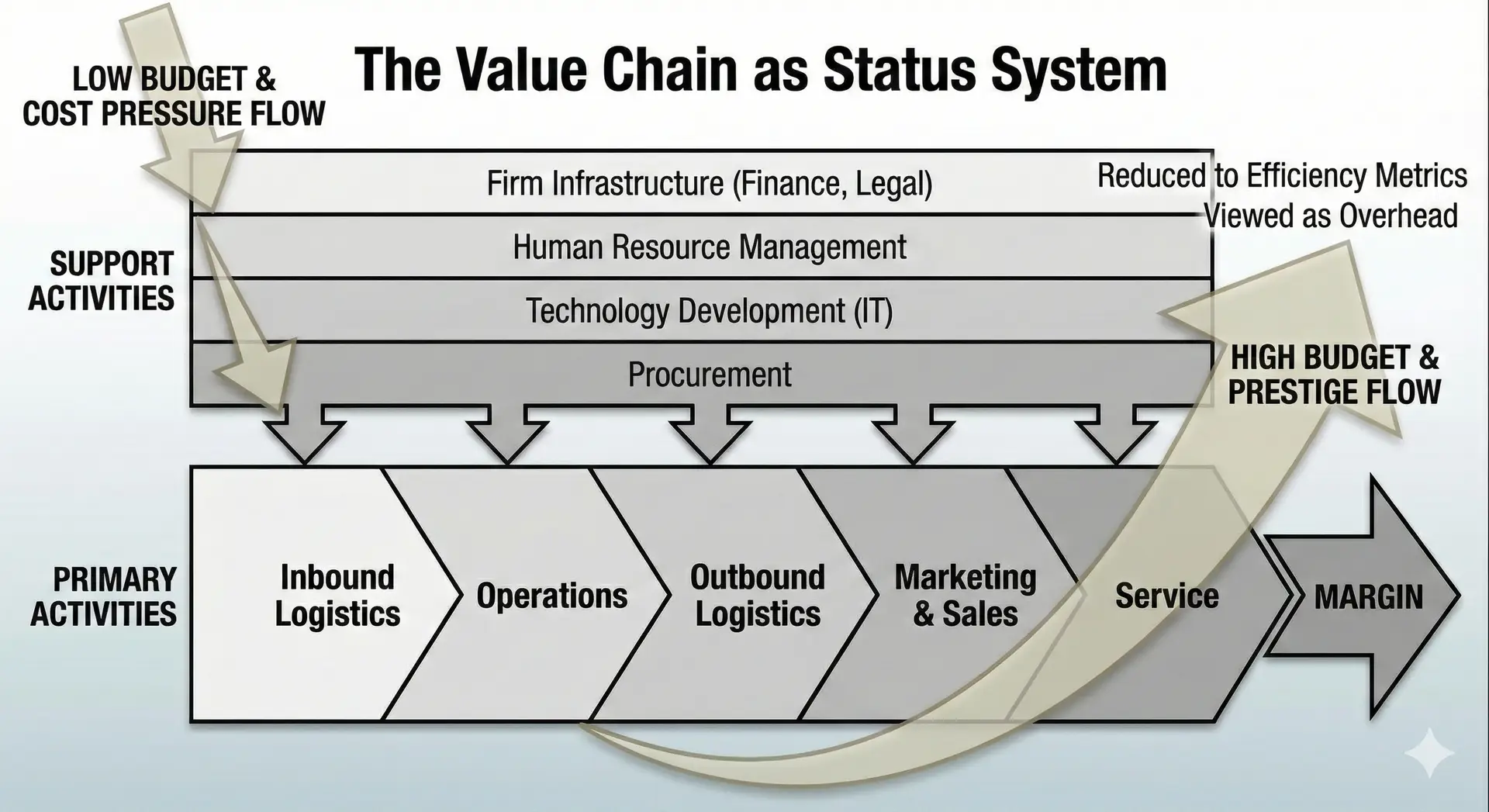

That hierarchy was reinforced by one of management’s most influential frameworks. In Competitive Advantage, Michael Porter distinguished between primary activities, which directly create value for customers, and support activities, which enable the primary chain. The intent was diagnostic. The practical effect in many firms was categorical. Primary became synonymous with value creation. Support became synonymous with overhead.

Artificial intelligence changes the economics that made this hierarchy seem natural. It lowers the cost of internal coordination, automates routine knowledge work, and allows expertise to scale across the enterprise at near-zero marginal cost. The result is that corporate functions can no longer be managed as service providers. They must build strategic plans with the rigor, ambition, and competitive intent of operating divisions. Firms that do this will move faster, learn faster, and allocate resources better. Firms that do not will find their most important capabilities leaking into shadow systems and external vendors.

The proof is already visible. Not in a future case study. In the daily economics of how work is being done.

1. How the support mindset became a strategic trap

Porter never implied that support activities were low value. Yet calling a function “support” quietly shaped how companies set priorities. Corporate functions were rewarded for efficiency: lower cost per hire, shorter close cycles, fewer legal hours, reduced IT spend. Those improvements mattered. They also narrowed the definition of what a function was for.

You can see the legacy in how functional strategies are still written. For the last twenty years, many corporate strategy decks for HR, Finance, Legal, and IT have orbit around efficiency questions: reduce the cost per hire, shorten the forecast cycle, compress contract turnaround time, lower ticket volume. It was a plausible mandate for a long time. “Do not mess up, and cost less than you did last year.”

This is the Service Level Agreement mindset. Business units request help. Functions deliver against response-time targets. Risk and throughput are managed, but the workflow stays largely intact. The function’s role is to serve the business, not to reshape it.

Peter Drucker famously said, “Efficiency is doing things right; effectiveness is doing the right things.”

AI creates a paradox: It radically improves efficiency. When AI agents can handle the scheduling, the reporting, the basic coding, and the initial auditing, the “Efficiency” metric hits a ceiling. You cannot get more efficient than instant.

Therefore, the only value left is Effectiveness. Unfortunately, in most centralized, corporate functions, effectiveness was hard to measure and rarely demanded. Efficiency became the proxy for value.

That must change. A strategic plan for a Finance Function in 2025 should not mention “closing the books faster.” That is table stakes. A strategic plan for Finance must explain how they will use data liquidity to price products dynamically in real-time, effectively changing the company’s revenue model.

2. AI rewrites the economics of coordination

AI sharply lowers coordination and internal transaction costs. Historically, corporate functions were guardians of these costs.

HR existed because finding talent on the open market was hard, slow, and noisy.

Finance existed because aggregating numbers from disparate units was manual and delayed.

Legal existed because standardized risk mitigation was cheaper than ad-hoc negotiation.

Generative AI drives the cost of those internal transactions toward zero. Routine drafting, searching, summarizing, and compliance checks are increasingly automated. Work that once required repeated human handoffs across functions can be handled in a single AI-assisted flow. Coordination becomes faster and less expensive. The center of gravity of corporate functions shifts from processing to designing systems.

There is a second effect that is easy to miss. When coordination costs fall, any remaining friction becomes more visible and more expensive in relative terms. If a sales leader can get a credible first-pass agreement from an external AI tool in minutes, a slow internal legal queue is no longer a neutral delay. It is a competitive penalty. Coase’s logic turns inward. Internal functions now compete with outside substitutes on speed, precision, and integration into work.

If that makes you slightly uncomfortable, good. It should. Your internal teams are no longer the only game in town. They are the incumbent facing a market that just got a lot cheaper.

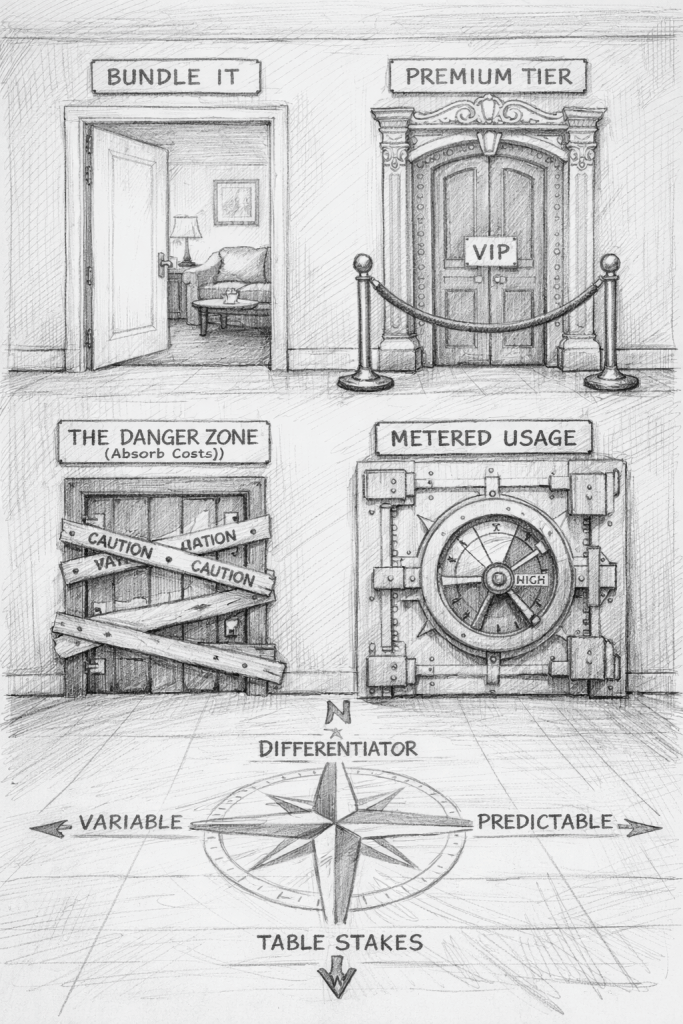

3. Zero marginal cost turns functions into platforms

Ben Thompson’s Aggregation Theory explains what happens when marginal costs collapse. When serving one more user becomes close to free, advantage shifts to whoever aggregates demand and controls the interface.

Apply that lens inside the firm. AI creates the same dynamic internally.

A corporate function that behaves like a service provider scales linearly with headcount. A corporate function that behaves like a software platform scales through reuse.

The Old Way (SLA Mindset): “The Engineering team needs 5 new hires. HR will process the requisitions in 14 days.” This is linear.

The New Way (Platform Mindset): “HR has built a predictive talent engine (The Product) that identifies attrition risks in Engineering before they happen and automatically nurtures a warm bench of candidates.”

In the second scenario, HR is not supporting the business; HR is generating differentiation for the business. They have built a moat.

Once you build a strong diligence engine, forecasting model, talent intelligence system, or data API, every business unit can use it without waiting in line. Every additional use improves the system through data feedback. The function becomes a platform with compounding returns, not a department with linear limits.

The strategic question changes accordingly. It is no longer “How efficiently do we process requests?” It becomes “What intelligence platform are we building, who uses it, and how does it change enterprise performance?”

4. Functional capabilities can be real moats

We know sustained advantage comes from capabilities that are valuable, rare, difficult to imitate, and difficult to substitute. AI turns functional expertise into exactly this kind of capability when built on enterprise-specific data and embedded into workflows.

An efficient payroll process is not rare; ADP or Workday can do it. A proprietary model that predicts which sales leaders will succeed in a specific territory, based on your firm’s history, culture, customer mix, and operating rhythm, is rare. You cannot buy that off the shelf or copy it from a rival without the same lived data.

Examples of this transformation:

- Legal: From contract review to proactive risk intelligence and strategic deal structuring

- Finance: From reporting to predictive resource allocation and scenario planning

- HR: From hiring to organizational capability development and workforce planning

- Supply Chain: From logistics coordination to predictive resilience and strategic sourcing intelligence

- IT: From infrastructure management to platform capability and business velocity enablement

- Marketing: From campaign execution to predictive customer intelligence and market sensing

In pre-AI companies, this knowledge lived in people and scattered process. In AI-enabled companies, it can be codified into platforms that scale. That is why functions must plan strategically. They now own some of the most defensible capabilities inside the enterprise.

AI shifts corporate functions from reactive service providers to proactive strategic partners—but only with intentional strategic planning.

5. What this looks like by function

Consider how this shift plays out in practice.

Legal: from gatekeeper to deal velocity and integration architect

JPMorgan’s COIN platform eliminated 360,000 hours of annual legal work reviewing commercial loan agreements. Most observers saw a productivity story. They missed the strategic insight: Legal can now apply big-deal rigor to every transaction, not just the largest ones. The constraint was never judgment quality—it was time.

Remove the time constraint, and different questions surface. Should Legal monitor regulatory changes across all jurisdictions and automatically translate them into risk alerts before quarterly compliance fire drills? Should they mine contract patterns across the entire portfolio to spot systemic risks or recurring commercial terms that leave value on the table? Should they become the function that accelerates complex partnerships rather than the bottleneck that slows them?

These aren’t compliance questions—they’re strategic positioning decisions. And they reveal why corporate functions need strategic plans. A competitor can license similar AI contract review technology. But they cannot replicate a system trained on JPMorgan’s specific deal history, their risk patterns, their negotiation outcomes, and their regulatory context. As Jay Barney’s VRIN framework predicts: the competitive advantage comes not from the tool but from the rare, inimitable capability built on enterprise-specific data and strategic choices.

Finance: From Historical Reporter to Strategic Advisor

Finance teams using AI-powered forecasting aren’t just producing reports faster—they’re shifting their role from historians to futurists. When Finance can run hundreds of scenarios quickly, testing different resource allocation strategies against market conditions that haven’t happened yet, they become the function that illuminates strategic options under uncertainty.

The strategic question becomes: Which scenarios should we model? What decisions are we enabling that leaders cannot make today? A Finance function without strategic planning will produce more forecasts. A Finance function with strategic planning will identify which three resource allocation decisions drive the most value in their specific business model, build predictive intelligence around those decisions, and shift leadership conversations from “what happened” to “what should we do.”

The capability is defensible precisely because it’s context-specific. Finance at a capital-intensive manufacturer faces different strategic questions than Finance at a software company with subscription revenue. The AI models, the scenarios, the decision frameworks—all must be built around the company’s specific economics, risk tolerance, and competitive dynamics.

HR: From Talent Acquisition to Capability Architecture

HR functions are making a parallel jump from filling roles to architecting organizational capability, and compensation is one of the first places where that shift becomes visible.

Syndio’s new AI-native product, Syndi, is a good illustration. Syndi shows what it looks like when HR stops acting like a help desk and starts acting like a platform builder. It delivers AI-guided, explainable pay recommendations inside the tools managers already use, like Slack, Teams, and ATS workflows, so offer and pay decisions happen with shared logic rather than one-off judgment. Because Syndi is built on Syndio’s decade of compensation and equity insights and is designed to expand across every pay moment over time, it creates a compounding decision system that keeps offers competitive while controlling spend and protecting internal equity at scale. The business impact is not “HR moves faster” or “we can hire more with less talent acquisition folks.” It is that the company can forecast talent cost and hiring tradeoffs with more confidence, avoid preventable attrition driven by inequity or mispriced roles, and treat pay as an active lever for capability strategy rather than a reactive approval step.

This is business impact, not HR optimization. In practical terms, the function is no longer just helping managers make offers. It is giving the business a continuously improving decision engine for how talent spend translates into growth and resilience, which is exactly the kind of advantage that compounds over time.

Supply Chain: From Logistics Coordination to Predictive Resilience

Supply Chain offers perhaps the starkest example of transformation. Traditional supply chain optimization focused on cost and reliability within known parameters—minimum inventory, lowest transportation costs, on-time delivery. These remain table stakes, but they’re no longer sources of advantage.

AI-enabled supply chain functions build something fundamentally different: dynamic understanding of risk and opportunity across their specific value network. A global manufacturer with decades of supplier relationships can train AI systems on which suppliers recovered quickly from past disruptions, which quality issues emerged under what conditions, how their demand patterns shifted across product lines and geographies.

This creates capabilities like predicting supplier financial distress before it impacts delivery (based on payment patterns and order volumes specific to your network), identifying alternative sources that match not just specifications but your operational rhythms, and dynamically rebalancing inventory based on early signals visible only in your channel data.

A competitor can license the same supply chain planning software. They cannot replicate the model trained on your supplier ecosystem, your product complexity, your customer demand patterns, and your risk preferences. Strategic planning means choosing deliberately: Which risks are we building intelligence around? Which supplier relationships do we invest in making strategic partnerships? Where do we accept less optimization to gain more optionality?

Marketing: From Campaign Execution to Market Sensing

Marketing’s transformation follows the same logic, though it manifests differently. Generative AI is making content production and personalization dramatically cheaper. Mondelez uses AI to produce and localize marketing content faster, accelerating campaign cycles and tailoring creative to specific audiences. Walmart is experimenting with ads inside its AI shopping assistant, recognizing that AI agents may become the interface where purchase decisions happen.

The strategic question isn’t “Can we produce more campaigns?” but rather “What market intelligence can we build that competitors cannot?” A B2B software company with fifteen years of customer interaction data—which use cases drove adoption, which value propositions won in competitive situations, which customer characteristics predicted expansion—can build predictive intelligence about their specific buyers in their competitive context evaluating their unique value proposition.

Generic campaign optimization tools are available to everyone. Intelligence about how your specific customers respond to your specific value propositions, built on your lived data, is defensible. But only if you build it strategically: choosing which customer intelligence matters, which market signals to monitor, where marketing shifts from execution to foresight.

The Pattern: Automation Enables, Strategy Determines

Across functions, AI follows a consistent pattern: it automates routine work, making efficiency cheap and abundant. This elevates strategic judgment as the scarce, valuable resource. But strategic judgment without strategic planning produces random insights, not compounding capabilities.

Finance running one brilliant scenario analysis doesn’t create advantage. Finance building systematic capability to illuminate strategic options—knowing which scenarios matter for their specific business model, which decisions create the most value, which uncertainties deserve the most attention—creates something competitors cannot replicate.

That capability requires strategic planning: deliberate choices about which intelligence to build, which decisions to enable, which questions to answer, and which capabilities to develop that compound over time. Without strategic plans, corporate functions will optimize locally—automating current work, implementing point solutions, pursuing generic efficiency. With strategic plans, they build rare, inimitable capabilities that determine how fast the company can move, how intelligently it allocates resources, and how effectively it navigates uncertainty.

That is why corporate functions need strategic plans just like operating divisions. They now own some of the most defensible capabilities inside the enterprise.

6. Internal customers still matter, but relevance is now contestable

Business units have long been treated as internal customers of corporate functions, with SLAs and shared-services models formalizing that relationship. AI complicates the dynamic. Internal demand may be captive in theory, but credibility is not. Business units can now source substitutes externally. That means functions must compete on quality, speed, and workflow integration, not just compliance and cost.

This competition is healthy when functions embrace it. It becomes existential when they ignore it.

7. What leaders should do now

The AI shift does not require that corporate functions imitate operating divisions in style. It requires that they match them in strategic seriousness.

So the job of the CEO, COO, and board is to reset the planning contract with functions. An annual functional plan should look and feel like a business plan: clear theory of advantage, explicit capability bets, a roadmap for scaling those bets through AI platforms, and metrics tied to enterprise outcomes. This is not just good governance. It is how you prevent internal relevance from being competed away by outside AI tools and shadow operations.

Senior leaders should press functions to answer four questions in their annual planning cycle:

What enterprise advantage can this function create that a business unit cannot create alone?

Make them pick a lane, not a slogan. “Be a strategic partner” is not an advantage. “Become the company’s proactive risk intelligence engine” is.Which functional services should be codified into reusable AI platforms, and what enterprise data will make them better over time?

The point is compounding. If a function is adopting tools that do not learn from usage or spread across units, it is not building a moat. It is renting one.Where are outside AI tools already substituting for internal services, and what friction points are making that rational?

Treat this like a competitive scan. Shared services and professional functions are prime targets for gen AI substitution precisely because the work is repeatable and text-heavy. KPMG If people are routing around the function, that is market feedback.How will this function measure effectiveness, not just efficiency, in terms the business recognizes?

“Cycle time down” is not enough. You want proof the function is changing outcomes: reduced preventable attrition in key roles, improved deal velocity with controlled risk, tighter capital allocation to the right bets, fewer supply shocks landing on customers.

Then add a second layer of pressure that most companies skip: force cross-functional platform alignment. HR, Finance, Legal, IT, Procurement, Supply Chain, Marketing, Support all touch the same operating reality. If each chooses tools independently, you get a patchwork that cannot compound. Leaders should require shared architecture choices and shared governance for enterprise AI platforms, or you replicate old silos with shinier software.

Finally, review functional plans the way you review operating plans. Ask what they are stopping to fund the platform bet. Ask what risks they are willing to take to get ahead. Ask how their roadmap changes the firm’s boundary with outside vendors. If the answers are vague, so is the strategy.

Conclusion: the strategic center either compounds advantage, or drains it

The easiest mistake right now is treating AI as a turbocharger for corporate functions—making them faster, cheaper, more efficient at what they already do. That path feels productive. Headcount stays flat or declines. Dashboards improve. Service levels hit green. But the company’s strategic trajectory doesn’t change, because the functions that touch every decision, every dollar, and every person are still optimizing for efficiency rather than effectiveness.

The companies that win will not have the fastest back office. They will have corporate functions that serve as the enterprise’s strategic intelligence core—building rare, inimitable capabilities that determine how fast the company can move, how intelligently it allocates resources, and how effectively it navigates uncertainty.

Consider what this means in practice:

Legal doesn’t wait for deal paper to review—it shapes deal design and integration pathways, using its intelligence about regulatory patterns, contract outcomes, and risk appetite to accelerate strategic partnerships that competitors find too complex or risky.

Finance doesn’t report the past—it reprices the future, running scenario-based allocations that illuminate strategic options and help leaders choose among them with clear-eyed understanding of risks and resource requirements specific to the company’s business model and competitive position.

HR doesn’t staff roles—it architects capability portfolios, using pay equity intelligence, skill mobility patterns, and predictive attrition signals to ensure the organization can execute strategies before they’re formally announced, because the capabilities are already being built.

These are not technology implementations. They are strategic choices about what the organization will become excellent at, what problems it will solve that competitors cannot, and what capabilities will compound over time into sources of advantage.

The strategic center of your organization—the corporate functions that touch everything—will either compound advantage through deliberate capability building or drain it through unexamined efficiency optimization. There is no middle ground. AI has eliminated the constraints that once made strategic planning for corporate functions impractical. What remains is a choice: Will you make it?

If you’re a functional leader or CEO rethinking your operating model for AI, I help teams turn corporate functions into strategic platforms with measurable business impact. Reach out here.