The most dangerous slide in any board deck right now is the “AI Monetization Strategy.”

In the last six months, across the various boards and executive teams I advise, I have watched a predictable panic set in. The CFO looks at the inference costs of the new generative AI roadmap. The CPO looks at the flat subscription fees of the current customer base. And the CEO asks the inevitable, terrifying question: “How do we pass this cost on to the customer?”

This is the wrong question.

If you attempt to pass on costs simply because your COGS (Cost of Goods Sold) have increased, you are operating with a utility mindset, not a software mindset. Customers do not care about your GPU spend. They do not care about your token usage or your vector database overhead. They care about outcomes.

We are witnessing a fundamental break in the SaaS business model. For two decades, software enjoyed near-zero marginal costs of replication. You wrote the code once and sold it a million times. AI changes this. It reintroduces variable costs—sometimes significant ones—into every single interaction.

The lazy response is a flat “AI add-on” fee. The strategic response is nuanced.

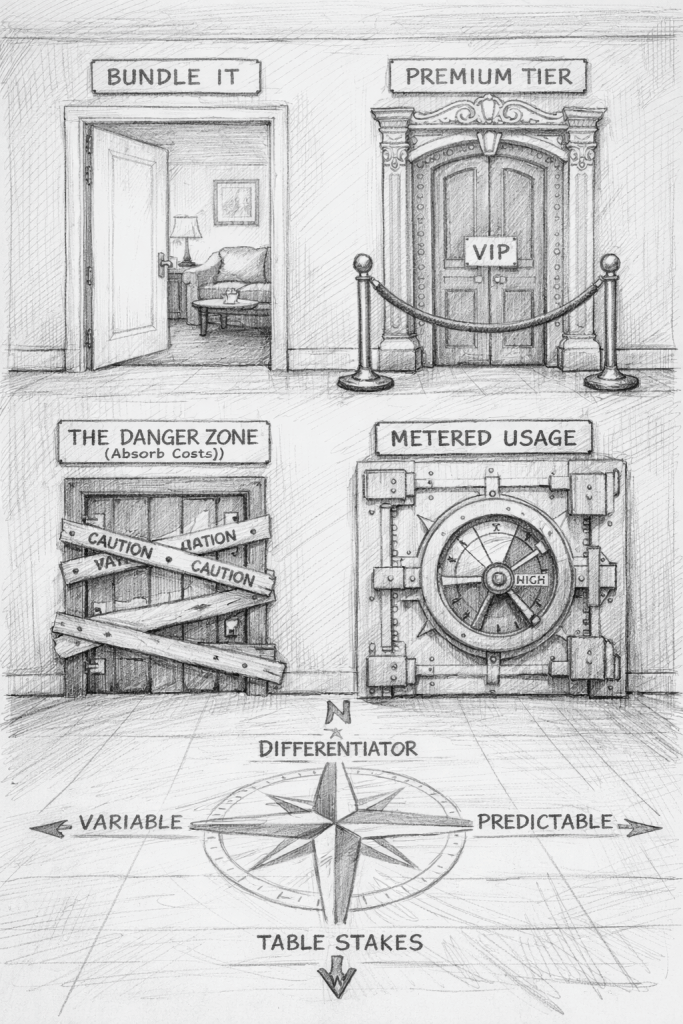

To navigate this, I use a specific mental model to help leadership teams decide what to bundle, what to meter, and what to put behind a premium gate. It requires mapping your features against two distinct axes: Competitive Necessity vs. Cost Structure.

Here is the strategic deep dive into the four quadrants of AI pricing, and how to govern them from the board level down to the product backlog.

THE CONTEXT: THE DEATH OF “ZERO MARGINAL COST”

Before we dissect the framework, we must acknowledge the environment. The “AI Tax” is real.

In traditional SaaS, gross margins hover around 80-85%. In AI-native apps, we are seeing those margins compressed to 50-60% because of compute intensity.

When you introduce a feature that relies on a Large Language Model (LLM), you are effectively hiring a very fast, somewhat expensive intern to do a task every time the user clicks a button. If you price that interaction like traditional static software, you will hemorrhage cash. If you price it purely on cost-plus, you will friction-kill your adoption.

The goal is not to protect your margin on every single API call. The goal is to protect the Customer Lifetime Value (LTV) while managing the blended margin of the portfolio.

THE FRAMEWORK: MAPPING VALUE TO COST

I advise clients to audit every proposed AI feature and place it on a 2×2 matrix.

The X-Axis: Is it Table Stakes or a Differentiator?

-

Table Stakes: “If we don’t have this, we lose the deal.” These features bring you to parity. They prevent churn. They are defensive.

-

Differentiator: “We win the deal because of this.” These features create new value, replace other vendors, or significantly accelerate a workflow. They are offensive.

The Y-Axis: Is the Cost Predictable or Variable?

-

Predictable: Low compute, lightweight models, infrequent usage, or deterministic code.

-

Variable: Heavy compute, complex chains-of-thought, high-frequency “always-on” agents, or massive context windows.

This intersection creates four distinct pricing strategies.

QUADRANT A: TABLE STAKES + PREDICTABLE COST The Strategy: Bundle It. Period.

There is a temptation to slap a “magic sparkles” icon on a text summarizer and charge $5 a month for it. Resist this.

If a feature simply makes your product easier to use, clearer to understand, or faster to configure, that is not a premium add-on. That is UX hygiene. In 2024, “Smarter Search,” “Contextual Onboarding,” and “Basic Summarization” are the baseline expectations for modern software.

The Logic: Your return on investment here is not a line item on an invoice. It is found in:

-

CAC Reduction: Higher win rates because your product feels “modern.”

-

Retention: Users get stuck less often because the AI unblocks them.

-

Support Deflection: Every time an AI “guided setup” answers a question, you save $15 on a support ticket.

The Governance View: If a Product Manager pitches a “Smart Search” add-on fee, I challenge them: “Will a customer leave us if we don’t have this?” If the answer is yes, you cannot charge extra for it. You bundle it to protect the core.

QUADRANT B: DIFFERENTIATOR + PREDICTABLE COST The Strategy: Premium Tier or Clear Add-On

This is the sweet spot for margin expansion. This quadrant represents AI features that do something a human used to do, but at a software-like cost structure.

Think of AI security analytics, policy enforcement engines, or advanced reporting. These features replace manual labor or external consultants. They provide high value (risk reduction, time saved) but, once built, the inference costs are relatively stable and manageable.

The Logic: You are selling the outcome, not the compute.

-

Example: A cybersecurity platform uses AI to correlate alerts. The cost to run the model is low (predictable), but the value to the CISO is massive (avoiding a breach).

-

Pricing: Move this into your “Enterprise” or “Pro” tier. This creates a compelling upsell path. You are not charging for the AI; you are charging for the advanced capability that happens to be powered by AI.

The Governance View: This is where you drive Net Revenue Retention (NRR). The board should ask: “What AI features are exclusively available in our highest tier?” If the answer is “none,” you have a packaging problem.

QUADRANT C: DIFFERENTIATOR + VARIABLE COST The Strategy: Usage-Based Pricing (The “Snowflake” Model)

This is the hardest shift for traditional SaaS leaders. Some AI features are incredibly valuable but computationally ruinous if uncapped.

Deep forensic analysis, video generation, fleet-wide document scanning, or generative code refactoring. These tasks consume massive tokens and compute time. If you bundle this into a flat fee, a “power user” will destroy your unit economics.

The Logic: Align price with value realization and cost incurred.

-

The Meter: Charge per document, per scan, per video minute, or use a “Credit” system.

-

The Psychology: Customers accept this when the correlation is clear. “I paid $50 to scan this repository, but it saved me 40 hours of legal review.” That is a fair trade.

The Governance View: Do not allow “unlimited” access to Quadrant C features without a Fair Use Policy or a backend cap. I have seen startups wiped out because they offered “unlimited AI generation” and a user scripted a bot to run it 24/7. This is a financial control issue.

QUADRANT D: TABLE STAKES + VARIABLE COST The Strategy: The Danger Zone (Absorb or Optimise)

This is the “Feature Factory” trap. This is where companies die a slow margin death.

This quadrant contains features that the market demands (Table Stakes) but are expensive to run (Variable Cost). For example, a “Chat with your Data” feature that requires a massive context window for every query, but users view it as just “standard search.”

The Approach: You cannot charge for it (customers won’t pay), but you cannot afford to run it (costs are too high). You have two options, and neither is pricing:

-

Engineering Optimization: Move from GPT-4 to a fine-tuned Llama-3 or a Small Language Model (SLM). Aggressively cache responses. You must engineer the cost out of the system.

-

The “Good Enough” Threshold: Limit the scope. Maybe the feature only looks at the last 30 days of data, not 5 years.

The Governance View: This requires ruthless prioritization. If a feature sits in Quadrant D, the board must ask: “Is this essential?” If yes, the engineering team’s KPI is not ‘velocity’—it is ‘cost per query.’

THE PREDICTION: FROM SEATS TO OUTCOMES

We are moving away from “renting tools” (SaaS) toward “hiring work” (Service-as-a-Software).

In the SaaS era, you sold a seat to a salesperson. In the AI era, you sell an “Agent” that does the prospecting. The pricing model must reflect that shift.

If you charge a “seat license” for an AI agent that does the work of three people, you are underpricing your value. If you charge “consumption” for a basic UI tweak, you are overpricing your utility.

The Pattern:

-

AI that keeps you competitive gets bundled.

-

AI that creates measurable advantage gets priced.

-

AI that eats compute must be metered or optimized.

Do not let your pricing strategy be an afterthought to your product strategy. In the AI era, your pricing strategy is your product strategy.

Price for the outcome, not the technology.

THE BOTTOM LINE

The transition to AI is a business model reset.

The companies that win in this next cycle won’t just have the best models; they will have the best economic engines. They will be the ones who refused to pass raw compute costs to their customers and instead found ways to monetize the measurable value they created.

Pricing is the ultimate signal of what you value and who you serve. Get it right, and you fund your innovation for the next decade. Get it wrong, and you are just subsidizing NVIDIA.

If you found this framework useful, subscribe to the newsletter for more board-level perspectives on Product Strategy and AI Governance. And if your executive team is currently struggling to align your pricing model with your AI roadmap, reach out. We should talk.