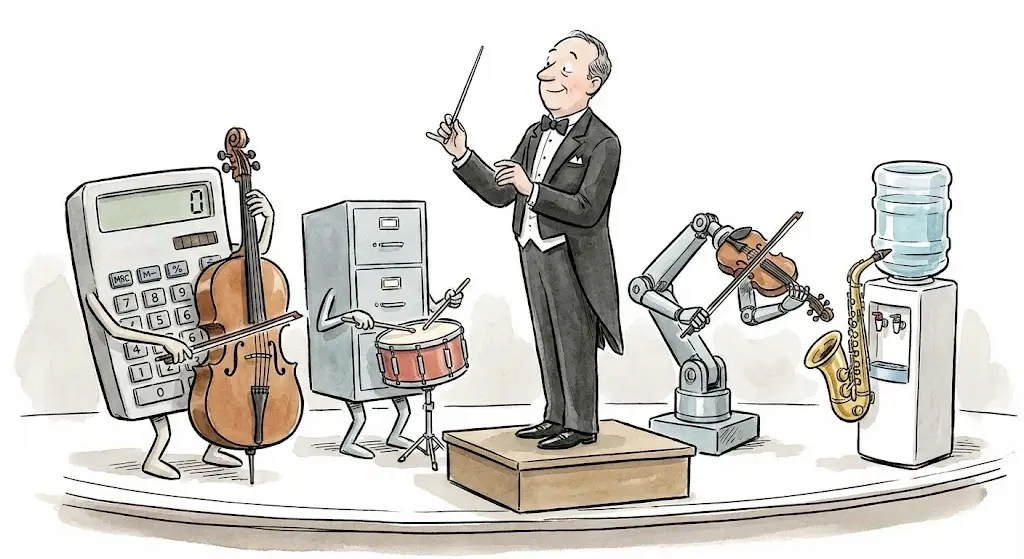

While Silicon Valley obsesses over AI replacing software engineers, a far more significant economic shift is occurring in the other 80% of the enterprise. For leaders in Finance, HR, Legal, and Operations, the arrival of “Agentic AI” is not merely a new software implementation; it is a restructuring of labor.

To understand the strategic implication, we must distinguish between the current generation of generative AI and agentic AI.

A standard LLM (like ChatGPT) is a consultant. You ask it a question, it provides an answer based on training data. It is passive.

An AI Agent is a digital employee. You give it a goal, and it autonomously breaks that goal into tasks, uses tools (your ERP, CRM, or email client), executes actions, observes the results, and iterates until the goal is met. It doesn’t just draft the email; it looks up the recipient, sends it, tracks the reply, and updates the database.

For the business leader, the strategic pivot is moving from managing people following processes to managing policies governing agents.

Below is an analysis of how this shift is playing out across key business verticals, the leading platforms, and critically, the operational realities and limitations facing early adopters.

1. Finance and Accounting: The Autonomous Controller

The finance function is arguably the ripest target for agentic automation due to its structured data and rules-based processes. The shift here is from high-friction reconciliation to exception-based management.

The Shift & The Tools

The current wave of tools moves beyond simple OCR (Optical Character Recognition) into semantic understanding of financial transactions.

-

Vic.ai is prominent in accounts payable (AP). It doesn’t just read an invoice; it acts as an autonomous AP clerk. It ingests invoices, categorizes costs based on historical data and general ledger rules, detects duplicates or fraud anomalies, and routes for approval only when its confidence score dips below a threshold.

-

AppZen: Focused on autonomous expense auditing. Rather than sampling expenses, it reviews 100% of transactions in real time, flagging fraud risk, policy violations, and duplicate spend. The shift is from reactive audit to continuous enforcement.

-

Numeric: A newer entrant rethinking the financial close with AI agents embedded in accounting workflows. It focuses on anomaly detection and variance explanations, reducing manual reconciliation work during month-end.

-

Brex AI: Embeds policy-aware AI directly into spend management. Instead of reviewing expenses after the fact, the system enforces policy at the point of purchase.

-

The Incumbent Play: Major ERP players like SAP and Oracle are aggressively embedding agentic capabilities into their suites to automate the “financial close” process, turning a monthly weeks-long scramble into a continuous, rolling audit.

The Reality Check: Limitations and Risks

The primary criticism of autonomous finance is the “Black Box Problem.”

-

Auditability Challenges: When an agent autonomously makes thousands of micro-decisions on general ledger coding, unwinding that logic during an external audit can be nightmarish if the system’s “chain of thought” isn’t perfectly documented.

-

Integration Fragility: Financial agents require pristine access to the “source of truth.” Critics note that these tools often stumble when layering over brittle, legacy on-premise ERP systems, requiring significant IT overhead to maintain data pipelines.

The Emerging Frontier: FP&A and Decision Intelligence

Beyond transactional accounting, agents are moving into financial planning and analysis. Tools like Pigment and Anaplan’s AI extensions are embedding agents that simulate scenarios, identify forecast anomalies, and recommend budget reallocations.

The strategic shift is subtle but profound: finance moves from reporting what happened to continuously stress-testing what might happen.

The risk: overconfidence in probabilistic models. Scenario outputs can appear precise while still being based on incomplete or biased inputs. Leadership must resist delegating strategic judgment to simulation outputs.

2. Human Resources and Talent: The Infinite Recruiter

HR is shifting from administrative processing to talent orchestration. Agentic AI is being deployed to handle the high-volume, repetitive top-of-funnel work that paralyzes recruiting teams.

The Shift & The Tools

Agents in this space are moving from simple FAQs to executing complex scheduling workflows across multiple stakeholders.

-

Paradox (Olivia) is a conversational recruiting agent used by major enterprises like McDonald’s and CVS. It engages candidates instantly via text or chat, screens them against basic requirements, and—crucially—autonomously accesses recruiter calendars to schedule interviews in real-time, handling cancellations and rescheduling without human input.

-

Gloat: An internal talent marketplace using AI agents to dynamically match employees to projects, mentors, and gigs, reshaping how large enterprises allocate internal talent.

-

HireVue: Uses AI-driven assessments and structured interview analysis. While positioned as efficiency software, its deeper implication is algorithmic influence over candidate scoring frameworks.

-

Workday AI Agents: Workday is embedding task-level automation agents directly inside HR workflows, moving beyond insights into execution within the system of record.

-

The Talent Intelligence Play: Platforms like Eightfold.ai use agents to scan internal workforce data, matching existing employees to open roles they haven’t applied for, effectively acting as an internal headhunter.

The Reality Check: Limitations and Risks

The critical friction point in HR is the “Uncanny Valley” of candidate experience.

-

Brand Damage via Automation: A common complaint among job seekers is the dehumanizing experience of being rejected by an obviously automated system after investing time in an application. If the agent’s conversational tone is poorly calibrated, it feels dismissive, damaging the employer brand.

-

Algorithmic Bias: There are ongoing, serious concerns that AI agents trained on historical hiring data inadvertently perpetuate past biases in screening decisions, creating legal and reputational risk.

3. Legal and Compliance: The Junior Associate

The legal vertical is characterized by high-cost labor performing high-volume text analysis. Agents here are acting as force multipliers for associate-level work.

The Shift & The Tools

The goal is to shift expensive human lawyers from “document review” to “judgment and strategy.”

-

Harvey.ai (backed by OpenAI) is designed specifically for elite law firms. It acts as an advanced legal research assistant and drafter. A lawyer can task the agent to “review this 50-page master services agreement against our standard risk playbook and redline deviations.” The agent identifies non-standard clauses and suggests alternative language based on the firm’s precedents.

-

Ironclad AI: Integrates agentic workflows across contract lifecycle management, from drafting to negotiation tracking to obligation monitoring post-signature.

-

Lexion: Focuses on extracting structured data from existing contracts and turning static agreements into searchable, analyzable corporate assets.

The Reality Check: Limitations and Risks

The legal sector faces the highest barrier to entry due to the consequences of error.

-

The Hallucination Risk: The most significant criticism of current legal AI is “hallucination”—confidently inventing case law or citations that do not exist. In a legal context, this is not a bug; it is potential malpractice. Human oversight remains non-negotiable.

-

Data Privacy and Privilege: Law firms are extraordinarily cautious about uploading sensitive client contracts into cloud-based models. The primary constraint on adoption is not capability, but data governance and attorney-client privilege concerns.

4. Procurement and Operations: The Autonomous Negotiator

Procurement is a rules-heavy, data-dense function with enormous financial leverage. Agentic AI here is evolving from spend analytics dashboards to autonomous sourcing support.

The Tools

-

Zip: Uses AI agents to orchestrate intake-to-procure workflows, routing requests across finance, legal, and security without manual intervention.

-

Fairmarkit: Applies AI to tail-spend sourcing, autonomously running competitive bidding events and recommending supplier selection.

-

Pactum: Deploys negotiation agents that autonomously conduct structured supplier negotiations within predefined guardrails.

The Reality Check: Limitations

Negotiation agents can optimize for cost while overlooking relational or strategic supplier considerations. Codifying negotiation logic requires explicit articulation of tradeoffs that many organizations have never formally defined.

The Infrastructure Question: Who Owns the Agent Layer?

Most enterprises are not building these agents from scratch. They are layering vendor agents on top of core systems such as SAP, Workday, Salesforce, and Microsoft.

This raises structural questions:

-

Who audits the agent’s decision logic?

-

Where is model fine-tuning happening?

-

What happens if the vendor changes pricing or model providers?

-

How portable are agent workflows across systems?

Agent sprawl without architectural discipline can create a new form of shadow IT, this time powered by autonomous execution rather than spreadsheets.

Leaders need a clear point of accountability for agent governance across the enterprise stack.

The Strategic Imperative for Leadership

The integration of Agentic AI is not a simple efficiency upgrade that allows you to cut headcount by 20%. It is a catalyst for organizational redesign.

The immediate implication for leadership is the hollowing out of the middle-skills layer. The role of the junior analyst, the paralegal, or the screening recruiter—whose job is primarily moving information from one system to another and applying basic logic—is being automated.

The economic impact will not unfold evenly. Functions that rely on structured data and policy-driven decisions will compress first. Roles dependent on tacit judgment, cross-functional negotiation, and political navigation will expand in relative value. The result is not simple job elimination; it is skill redistribution at scale.

The deeper shift is structural. When work is executed by autonomous agents, leadership stops being about supervising activity and becomes about designing constraints. Policies, permissions, escalation thresholds, auditability standards, and accountability structures become the new levers of control.

This is not an IT initiative. It is an operating model decision.

Who defines the rules an agent follows? Who reviews its decisions? Who owns the outcome when it acts within policy but produces the wrong result? These are executive questions, not product questions.

Organizations that treat agents as productivity tools will automate tasks. Organizations that treat agents as a new layer of digital labor will redesign how authority flows through the company.

The difference will determine whether agentic AI becomes incremental efficiency or institutional advantage.

Organizations that treat agents as productivity tools will automate tasks. Organizations that redesign authority, accountability, and policy around digital labor will reshape their cost structure and decision velocity. That is the second wave.